_edited.jpg)

Negative Inventory in QuickBooks

Table of Contents

Resolved by QBA Services Team

Update 2 days ago

______________________________________________________________________________________________________________

What is Negative Inventory?

Negative inventory occurs when you have sold more products than you have in stock. This can happen when you enter a sales order or an invoice without checking the inventory levels. As a result, QuickBooks shows a negative quantity in your inventory. This can lead to inaccurate financial reports and affect your business's profitability.

Note: Create a backup copy of the file before making any changes in the file.

Please see How to create a Quickbooks Company File Backup Click Here

There are several causes of negative inventory in QuickBooks. Some of the most common ones include:

1. Data Entry Errors

Data entry errors are one of the most common causes of negative inventory. This can happen when you enter a sales order or an invoice without checking the inventory levels. Always double-check the inventory levels before entering a sales order or an invoice.

2. Delayed Data Entry

Delayed data entry can also lead to negative inventory. This can happen when you enter a sales order or an invoice after the product has been sold. Make sure to enter the sales order or the invoice as soon as possible.

3. Adjustments and Transfers

Incorrect adjustments and transfers can also cause negative inventory. This can happen when you transfer products from one location to another without updating the inventory levels.

4. Multi-User Access

If multiple users have access to QuickBooks, it can also cause negative inventory. This can happen when one user enters a sales order or an invoice while another user is updating the inventory levels.

How to view negative inventory in you Quickbooks Company file.

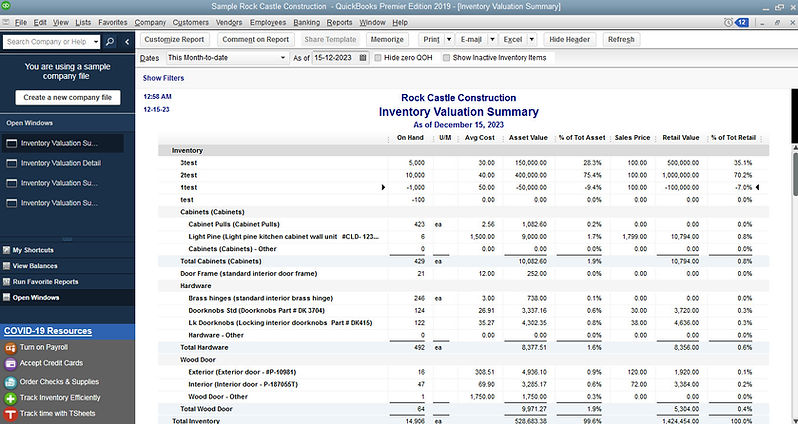

Negative Inventory shows on your balance sheet but primarily it shows on the following reports:

-

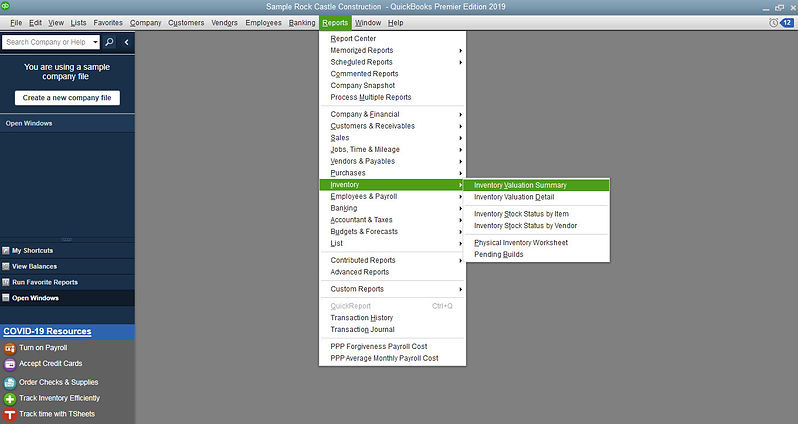

Go to the Reports menu, Click inventory and then select Inventory Valuation Detail (IVD) report OR Inventory Valuation Summary (IVS) report, Inventory Valuation Detail (IVD) report.

Inventory Valuation Detail (IVD) report.

Inventory Valuation Summary (IVS) report.

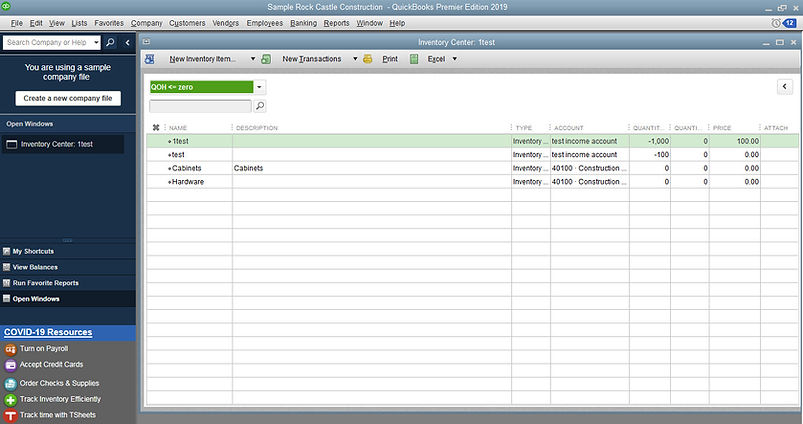

The Inventory Center Report under Vendors menu can also give you this report

-

Go to the Vendors menu, Click Inventory Activities and then Inventory Center.

2. Go to the top left of the Inventory Center window, change the filter from Active Inventory to Assembly to QOH <=Zero.

How to fix a negative inventory in you QuickBooks Company file.

-

Choose Inventory; click Inventory Valuation Summary from the QuickBooks Reports menu.

2. Change the report to show All Dates

3. QuickZoom an item that is showing incorrect values by double clicking the item name. This opens the Inventory Valuation Detail report for the item. The transactions associated with this item are listed in order by date.

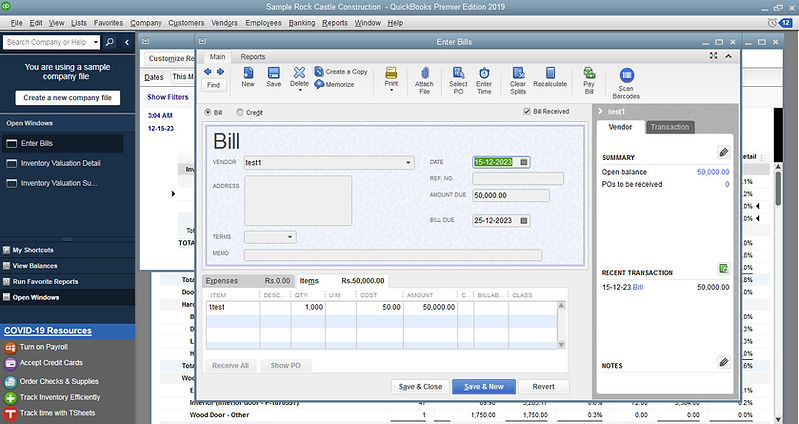

4. QuickZoom the first Bill listed to open the Enter Bills window and Change the date on the bill to a date earlier than the first invoice listed on the detail report you opened in Step 3.

5. Click Save & Close to record the bill with the new date and Repeat Steps 3 through 4 for each incorrect item.

NOTE: When you follow the process to correct negative inventory, take necessary precautions to avoid potential problems. For example: Back up your data and keep it safe. Try to look at process that you need to eliminate each occurrence separately. Before you do anything, touch base with your accountant to confirm that the changes you are making are valid.

How to prevent negative inventory in you Quickbooks Company file.

Note: To stop these issues from occurring: Never sell inventory items until you have purchased them and entered the purchases into QuickBooks.

Set up inventory items with an opening balance

1. You need to enter the quantity on hand and value to establish the average cost at the time of creating the inventory item.

2. Use non-posting estimates and sales orders to track sales for which you do have inventory – First, enter the customer order as an estimate or sales order. Next, purchase the inventory item and enter the purchase into QuickBooks. Convert the estimate or sales order to an invoice.

3. Set Preferences to warn your potential problems

The steps: Under Edit > Preferences > Items & Inventory > Company Preferences, you’ll find a check box to “Warn if not enough inventory to sell.”

Incase If you need more assistance with negative inventory or any other Quickbooks issues, please contact us.